Dollar Cost Averaging Bitcoin: A Smart Investment Strategy for Crypto Enthusiasts

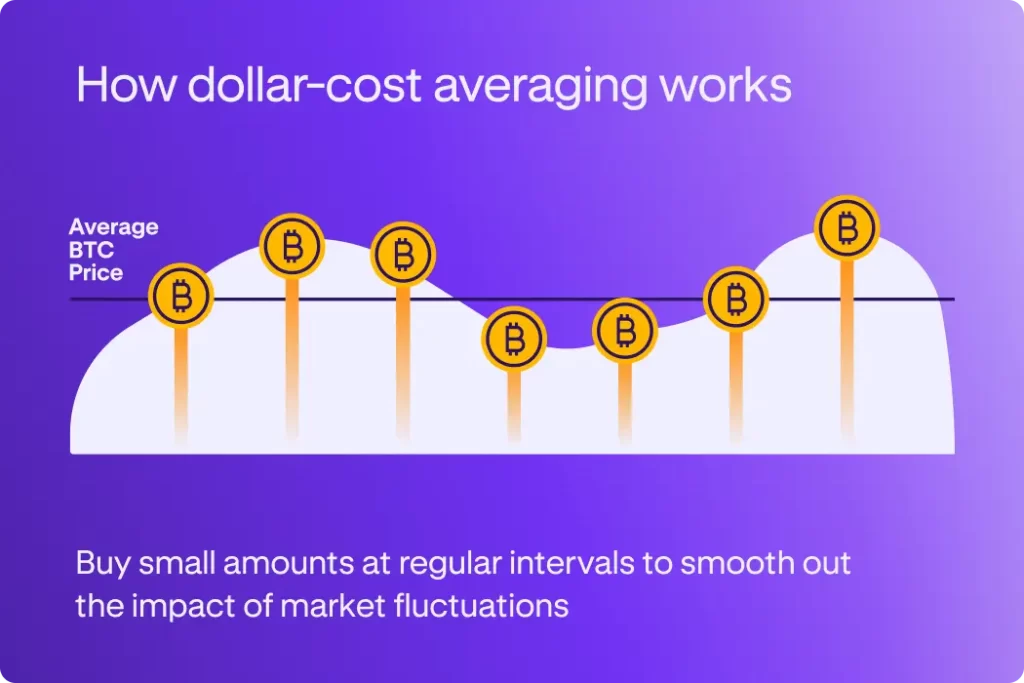

Dollar cost averaging (DCA) is one of the simplest and most effective strategies for investing in volatile assets like Bitcoin. With the cryptocurrency market characterized by dramatic price fluctuations, many investors struggle with the timing of their purchases. This is where DCA comes in. Instead of trying to predict market movements, this strategy allows you to invest a fixed amount of money in Bitcoin at regular intervals, regardless of its price. By spreading your investments over time, you minimize the risks associated with market volatility while benefiting from long-term price trends.

Whether you’re a seasoned investor or a crypto newcomer, dollar cost averaging can help you build a Bitcoin portfolio in a disciplined and less stressful way. In this guide, we’ll explore how DCA works, its benefits, and how you can implement it to make the most of your Bitcoin investments.

What Is Dollar Cost Averaging (DCA)?

Definition and Basics Dollar cost averaging is an investment strategy where you divide your total investment into smaller, equal amounts and invest them at regular intervals, regardless of the asset’s price. This means you buy more of the asset when prices are low and less when prices are high, potentially lowering the average cost per unit over time.

How It Works in Traditional Markets vs. Crypto In traditional stock markets, DCA is often used to invest in mutual funds, ETFs, or individual stocks. In the crypto world, it’s particularly valuable due to the extreme volatility of digital assets like Bitcoin. For example, Bitcoin prices can swing by 10% or more in a single day. By using DCA, you avoid the risk of investing a large sum at the wrong time, such as during a market peak.

Why Use DCA for Bitcoin? Bitcoin’s price history is marked by significant highs and lows, making it a challenging asset to time perfectly. DCA removes the emotional aspect of investing and focuses on consistency. Whether the market is bullish or bearish, this strategy ensures you’re continuously building your Bitcoin holdings without worrying about short-term price movements.

The Advantages of Dollar Cost Averaging Bitcoin

1. Mitigating Market Volatility Bitcoin’s volatility is both a risk and an opportunity. With DCA, you don’t have to worry about timing the market. Instead, you’ll buy Bitcoin at both high and low prices, which averages out over time. This approach protects you from the emotional stress of investing a large sum during a market peak.

2. Psychological Benefits Investing in cryptocurrency can be nerve-wracking, especially during market downturns. DCA removes the guesswork and emotional decision-making, helping you stick to your investment plan even during periods of uncertainty.

3. Building Discipline DCA enforces a disciplined approach to investing. By committing to regular investments, you’ll develop a habit of consistent saving and investing, which is crucial for long-term wealth building.

4. Long-Term Gains Bitcoin has historically trended upward over the long term, despite its short-term volatility. By consistently investing through DCA, you’re more likely to benefit from these long-term trends without exposing yourself to unnecessary risks.

Step-by-Step Guide to Dollar Cost Averaging Bitcoin

Step 1: Set Investment Goals Before you start, define your investment objectives. Are you investing for retirement, a major purchase, or simply to diversify your portfolio? Knowing your goals will help you determine the amount and frequency of your investments.

Step 2: Choose a Fixed Investment Amount Decide how much you can afford to invest regularly without straining your finances. This amount should be manageable and consistent to avoid interruptions in your DCA strategy.

Step 3: Select a Time Interval Choose a regular interval for your investments, such as weekly, bi-weekly, or monthly. The interval should align with your income and budgeting cycle.

Step 4: Pick a Reliable Platform Select a trusted cryptocurrency exchange or app that supports automated DCA. Platforms like Coinbase, Binance, and Kraken offer features that allow you to set up recurring Bitcoin purchases.

Step 5: Monitor but Don’t Obsess While it’s important to track your investments, avoid micromanaging or making impulsive decisions based on short-term market movements. Remember, the goal of DCA is to minimize stress and focus on the long-term picture.

Historical Performance: Does DCA Work for Bitcoin?

Bitcoin’s price history provides compelling evidence for the effectiveness of DCA. For example, if you had started investing $100 per month in Bitcoin in January 2018—during a market peak—you would have seen substantial gains by the end of 2021, despite the bear market in 2018 and 2019.

Using historical data, studies show that DCA consistently outperforms lump-sum investments made during market peaks. By averaging out your purchase price, DCA reduces the impact of price volatility and maximizes the benefits of long-term growth.

Including a graph here to visualize how DCA would have performed over various time periods can further emphasize this point.

Tools and Platforms for DCA Bitcoin Investments

Crypto Exchanges Most major crypto exchanges, such as Coinbase, Binance, and Kraken, offer automated DCA tools. These platforms allow you to set up recurring purchases with minimal effort.

Third-Party Apps Apps like Swan Bitcoin, Strike, and Cash App specialize in DCA for Bitcoin. They often provide user-friendly interfaces and low fees, making them ideal for beginners.

Manual DCA If you prefer more control, you can manually purchase Bitcoin at regular intervals. While this requires more effort, it can also help you avoid platform-specific fees.

Security Considerations No matter which platform you choose, prioritize security. Use hardware wallets like Ledger or Trezor to store your Bitcoin securely and enable two-factor authentication (2FA) on your exchange accounts.

Common Mistakes to Avoid While DCA Bitcoin

1. Investing Beyond Your Means Never invest more than you can afford to lose. Crypto investments are inherently risky, and overextending your finances can lead to unnecessary stress.

2. Impatience with Results DCA is a long-term strategy. Avoid the temptation to evaluate its success based on short-term performance.

3. Choosing Untrustworthy Platforms Research your chosen exchange or app thoroughly. Look for platforms with strong security measures, low fees, and positive reviews.

4. Ignoring Market Trends Completely While DCA eliminates the need for market timing, staying informed about market trends and news can help you make better investment decisions.

DCA Bitcoin vs. Other Investment Strategies

HODLing HODLing involves buying and holding Bitcoin for the long term, regardless of price fluctuations. While similar to DCA, it lacks the consistent purchasing schedule that helps mitigate risk.

Active Trading Active trading requires constant monitoring of the market and attempting to profit from short-term price movements. DCA, on the other hand, is more suitable for investors who prefer a hands-off approach.

DCA vs. Staking Staking involves locking your crypto assets in a blockchain network to earn rewards. While staking can provide passive income, it’s not as effective as DCA for building a diversified Bitcoin portfolio.

Is Dollar Cost Averaging Right for You?

DCA is ideal for investors looking to build wealth over time without taking on significant risks. It’s particularly suitable for:

- Beginners who want a simple and stress-free way to invest in Bitcoin.

- Long-term investors who believe in Bitcoin’s growth potential.

- Those with limited funds who prefer incremental investments.

However, if you’re a short-term trader or have a low risk tolerance, DCA might not be the best fit for your needs.

Case Studies and Success Stories

To illustrate the effectiveness of DCA, let’s consider a hypothetical example:

If you had invested $50 weekly in Bitcoin starting in 2017, you would have experienced significant growth by 2021, despite the 2018 bear market. This example highlights how DCA helps you benefit from both bull and bear markets by averaging out your purchase cost.

Frequently Asked Questions (FAQs)

1. What’s the minimum amount needed to DCA Bitcoin? Most platforms allow you to start with as little as $10 per transaction.

2. Can DCA work during a prolonged bear market? Yes, DCA can be particularly effective during bear markets, as you’ll accumulate more Bitcoin at lower prices.

3. How do I automate DCA with minimal fees? Choose platforms with low transaction fees and set up recurring purchases.

4. Should I stop DCA during a market crash? No, market crashes provide opportunities to buy Bitcoin at discounted prices, which can improve your long-term returns.

Conclusion: Why DCA Is a Winning Strategy for Bitcoin Investors

Dollar cost averaging is a proven investment strategy that simplifies Bitcoin investing while minimizing risks. By investing a fixed amount regularly, you can build a robust Bitcoin portfolio without worrying about market timing or volatility. Whether you’re a beginner or a seasoned investor, DCA offers a disciplined and stress-free approach to participating in the cryptocurrency market.

Call to Action

Ready to start building your Bitcoin portfolio? Explore the benefits of dollar cost averaging today. Start small, stay consistent, and watch your investments grow over time!